An Exit Signal comes out for the Robot Dog “B” implies a reversal point of the short term rise trend.

An Exit Signal comes out for the Robot Dog “B” implies a reversal point of the short term rise trend.

It has confirmed that Donald Trump to be the next US president. As a simple man in the eastern world, I would like to discuss what impacts of Donald Trump to our surviving? Will anything change? Will anything remain the same? What do I hope for Trump?

Let start with the development of the eastern world. One belt one road policy will continue no matter who are the president of US. Will Trump take down the Transpacific Partnership Policy (TPP) agreement and join the one belt one road policy with China? It goes back to the simple question. Will Trump stop the money printing machine?

I bet what Trump cannot stop are the Economic Collapse, the Debt Collapse, the Boast of the Real Estate Bubble. If Hillary won, she would try every way to delay them by the support of money printing. Doing so, it has higher possibility to go to war. I guess a businessperson like Trump will sell off the negative cash-flow business rather than make it up. He may find what the eastern world wants from the US and try to make a deal to minimize the impacts of the three bubbles. On the other hand, he will make use of force from the boast of the three bubbles to start the reform of the US government, politics and economy.

I bet that US dollars will depreciate 50% on Chinese YUEN to recover a trade balance. Transpacific Partnership Policy (TPP) may change to a less aggressive approach to harmonize with the one belt one road policy of China.

Doing business can improve the employment of US by pushing the infrastructure works. Trump may have less burden on the Oil interest. A business deal between west and east powers about the oil interest in the middle east can be easier to make.

The market in the US may be more open to China companies. China may be able to buy some high-end technologies from the US. The conflict between EU and US may end.

A transform of the power structure within the US may happen soon. Bankers may face a lot of challenges. A substantial reform may be necessary for those US banks. Doing so, the balance sheets of US companies and banks may face the truths. The price of stocks may drop sharply. The price of gold, silver, and bitcoin will rise quickly.

For the eastern world, one belt one road policy in China will not change. Gold-backed currency direction remains the same. I hope the possible outcome is both countries can escape from war to make a business deal. The opportunity cost will be much less than war. I hope it gives a smooth transition to the US and the world.

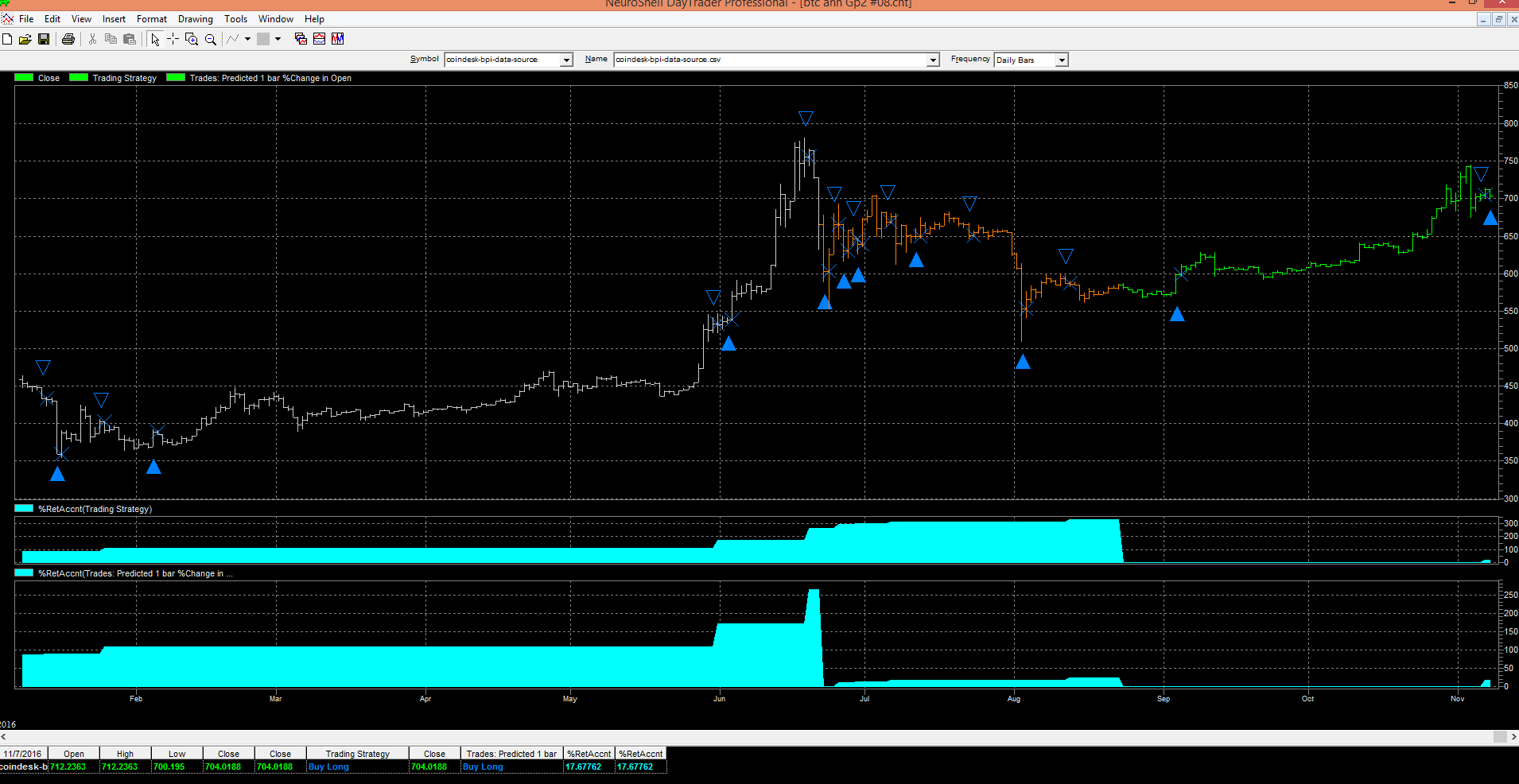

Here is my AI model – named Robot Dog “B” which is an artificial intelligence bitcoin trading model. (You may reference for the bitcoin market analysis details here.) Please see the trading signals in the first chart.

There was a long-term rising trend started from 3rd September 2016 (See the BUY signal in the charts.) to 5th Nov. 2016 (An Exit signal). Two days later (i.e. 7th Nov. 2016, that is yesterday), a new BUY signal appeared. It indicates that the Exit signal on 5th, Nov. 2016 did not imply the END of the upward trend. Instead, the new BUY signal confirmed that the upward trend continues.

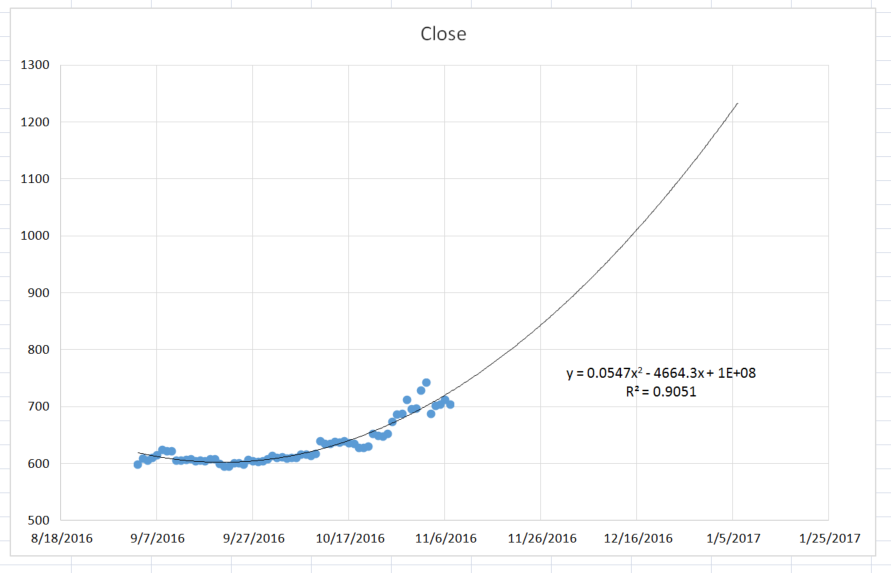

I build up a regression model for bitcoin chart analysis and project the Bitcoin price to be $1200 in January 2017. The chart as here.

My students have assignments to talk about the how future technology 10 years later impact the world. It makes me have a thought to project how technologies in 10 years (to 2025) will change our world. I have the following visions when I am standing on the timeline of 2025.

1. Federal Reserve Notes became the history because It ended five years before. Federal Reserve Board disappeared too.

2. Gold and Silver become the backup of world currency. Gold Trade Notes and Silver Trade Notes adopted in the international trades.

3. Bitcoin becomes the protocol for the inter-bank transaction clearing backbone.

4. World trade is mainly using the high-speed railways instead of ships on the oceans. The high-speed railways bridge the channel from China, Russia, Mid-east, Africa, Europe to the UK.

5. International companies move their automation to blockchain like ethereum. The smart contract is well-developed. It saves a lot of cost on lawyers, accountants, and managers.

6. Governments become less in size because the private economy is much profitable and less working time per day which attracts people to work in private sectors.

7. Smart contract connects most of the electronic payment gateways and robots. Free energy technologies are available. People can work a few hours per day to support their families.

8. Cars do not have human drivers because they controlled by a centralized Artificial Intelligence.

9. Nanotechnologies widely used in multi-industries. The duration of materials as much longer and less maintenance work is required.

10. 3D printing replaced big factories. If you want something in a home, just download the file and print it out.

11. Goods are very cheap. So, the difference in living standards between rich and poor are not so much.

12. War is not necessary because its opportunity costs are far too high comparing do trade with others.

13. Young people prefer not to go to Universities and develop their own business because universities graduates earn much less.

14. Low-cost curing is available which cost much less to the health of humanity. A medical doctor is not the goal for youngsters.

15. Air pollution improved much because all cars are electric.

Today is 3rd November 2016. According to the coindesk.com, the price of a single Bitcoin (BTC) is USD743. My friend asked me “Is it a good time to buy BTC?” To answer this question, I would like to break it down into several viewpoints to analysis. Firstly, what is the nature of a Bitcoin? Can it store value? Why it’s price increase so much? Can this upward trend be continued? Where is the price – top, bottom, in the middle of upward or downward?

OK! Let start with what is a bitcoin? The Internet has different protocols. The HTTP protocol is for website browsing. FTP protocol is for transfer of electronic files. Bitcoin protocol is for transfer of financial value in an open ledge called blockchain. There is a ceiling on the total number of bitcoin to be generated which is 21 MILLION. Unlike the fiat currencies which has no limit on the number to be printed. Bitcoin mining is the process to get new bitcoins, but the difficulties are progressive greater. In other words, there is a hard scarcity of this transfer of value function protocol “bitcoin“. People who want to transfer of value by this protocol should need to use their fiat currencies to buy it. It returns to the demand and supply economics. If the demand is getting greater and the supply is limited, the price will increase. Inversely, if the supply is greater than the demand, the price of BTC will drop.

It can store value because of the demand and supply equilibrium. It is very limited in number. It has a large amount of demand in the present circumstances. So, what are our position of the world economy now? To my personal point of view, it is in the darkness moment before the shiny morning. Why did I say so?

Quantitative easing began in 2008 and now becomes the QE infinity. The world economy cannot sustain this system forever. The eastern world has already established their system which will use gold-backed currency as the backbone to support the trades in-between counties. China’s one belt one road policy created on this backbone. It is easy to forecast that one day sometime from now. China will announce Chinese RMB is gold-backed. In contrast, the western unbacked currency system is near collapse. Money printing to infinity means money is worth nothing.

China is tightening the control the financial outflow of money. RMB trends to devalue on USD and gold. Chinese try ways to bring their money outside China. If the bank transfer blocked, Bitcoin will be the way to move the value outside the country.

Bitcoin halving has come across in July. History told us that the effect of Halving would manifest in the coming one year. (Halving means the number of bitcoin generated is reduced by 50% during the mining process every four years.)

US presidential election always means a catastrophe change on the world economy. I suggest you read the Roadtoroota Theory by Bix Weir and the Webbot ALTA report from Clif High and jsmineset.com from Jim Sinclair and Bill Holter. If you believe there is always a battle between good guys and bad guys behind the curtain, it is the time to get HOT at this moment.

In the short term, Webbot forecast that the price of a bitcoin will go to over $1000. According to my AI model BitBot for bitcoin, it is also on an upward trend.

Bitcoin’s supply is very limited with a significant demand. It can store value. The demand is getting greater and greater, and so the price will increase in the long-term. It is a moment for an upward trend just begin.

99% of the world’s currencies are fiat currencies. All those fiat currencies are the derivative of US dollar (to be accurate the Federal Reserve Note (FRN)). Taking my city, Hong Kong, as an example, there are three banks in Hong Kong (HSBC, Standard Charter and Bank of China) can print Hong Kong Dollar. They need to buy one US dollar (FRN) to print around HKD 7.75 to 7.8. In the financial tsunami of 2008, the quantitative easing in USD pumped an enormous amount of money supply to FRN.

Source: http://www.tradingeconomics.com/

At that time, the Hong Kong SAR government begin to plan many infrastructural projects to the public. In 2008, the unemployment rate of this city suddenly increased a lot. One possible reason for the pushing construction project may be to improve the economy, and this can also improve the unemployment rate.

In the construction industry, the contractors worried that there are not enough projects to run their business. When the contractors bid the government projects, they may use a lower profit margin bidding strategy to win the bid. Unfortunately, after they won the bid and two years later, they found that the construction cost increase significantly (over 50% to 100% range) within a very short time frame. This sudden increase in construction cost was unexpected even for professionals who may have 30 years experience in the industry. The hidden reason behind may be the quantitative easing of the USD (FRN). When the money supply of USD increases, the linked currency like HKD will also increase which can keep the exchange rate constant (1:7.8). When there is significant much more HKD flow into the market, the purchasing power of each dollar of HKD is diluted. That is why fiat currency cannot store the value of your hardworking.

Go back to the question why we cannot work just 4 hours per day to support our living. The inflation becomes a significant issue. Many people bought real estate property to store their hardworking value. To invest in property, we need to take into account some extra more risk. Firstly, many people buy properties by mortgage from banks. To have a mortgage, you just like to trading stocks share with margin. When the price of the stock drops instead of increase, it firstly losses the deposit and then it may have a margin call. To overinvest in the property market with a mortgage, it involves the monthly repayment of the loan. Many people use their monthly earning to support the monthly repayment. Some investors will rent out the flat and use the rent to repay the monthly repayment. However, when the market enters into the downward cycle, it will not be in a single market, single industry or one location. Our world interconnects to each other. No single industry are insulated. No single market is alone. No single location is separated. That means when the price of properties drop, it will bring down the stock prices, the rental value of fiat and your monthly salaries.

In my point of view, to buy something scare in the world without loan can play safely in the long term and protect our wealth. The answer is Bitcoin, physical silver, and physical gold. Many people criticized that those investments cannot generate passive income. If you buy stocks, it can produce the dividends which are passive income. My answer is “Oh Sorry! In the money printing world, the first thing first is to protect the purchasing power of our wealth instead of the digital numbers of fiat currency. Those digital numbers are just the illusion.

If you want to have a passive income on your investment, you may consider investing on Wealthy Affiliate like me. Try to spend a little on Google AdWord, build up your blog (website), publish it to the world. It will be a property which can generate a passive income step by step. It will be a property in near future.