Category: Bitcoin

Deep state declare wars on bitcoin and cash

There is an important article which points out the purpose of the deep state to manipulate the India to ban the 1000 Rupee, and 500 Rupee cash is to suppress of demand of physical gold. Thanks for the writer of this article who pointed out this possible initiative of the action behind the India. India is a country who has a constant demand for physical gold. To ban the high-value paper cash will have a substantial impact on the demand for physical gold which can suppress the gold price. The spot price is following the COMEX gold transaction price. Unfortunately, 99% of transactions in COMEX are paper gold rather physical gold. The difference of price gold between Shanghai Golden exchange and US one is getting large from $10 to $20. Chinese do not agree on the price direction from US COMEX exchange because Chinese is now trading the physical GOLD contract rather than paper gold contract. The ratio between the physical GOLD and paper gold is over 250 in US market. Banks use the paper gold transactions to suppress the gold price. If the price breaks out the $1,500 range, it will go to $2,000, $5,000 and $50,000. The western banking system will blow out.

Therefore, to prevent the ignition of the fire in the insolvent banking system, a lot of paper future contracts are used to manipulate the price of gold and silver. Otherwise, the hyperinflation has already happened under the QE to infinity policy.

Bitcoin is a new market that a small proportion of people known what it is and how to invest on it. There is no future contract on bitcoin. The deep state cannot fully control the bitcoin’s price by the paper contract.

All physical GOLD, SILVER, and Bitcoin share the same characteristic of scarcity. They can store value under the QE to infinity and help people to escape the banking system – a safety heaven.

The deep state declared wars on bitcoin too. Coinbase dot com are required by the IRS to provide their records of previous three years. The bitlandngclub.com – a peer-to-peer loan platform was requested by the government to stop services. One bitcoin exchange in Hong Kong – bitfirst.com has cut their Hengsang bank (a sub-group of HSBC) account.

However, insolvency is insolvency. It is a mathematical certainty. The only uncertainty is when will this event happens. Whatever the deep state did, it is a matter of time.

All those tactics the deep state did are reflected that the day of the event is very near. Webbot ALTA report on December 2016 mentioned that there would have a big change after 12th Dec 2016. I checked the calendar-365.com. 13th Dec 2016 is the day of full moon.

Stankov believes that there some possible points we should take care.

1) China implements a massive one-off devaluation of the Yuan.

2) The $10 Trillion US Dollar carry trade blows up. (This is already happening now as the dollar is being repatriated after Trump’s victory. Note, George)

3) The $199 Trillion Bond Bubble implodes as debt deflation ripples through the financial system.

4) The $555 Trillion derivatives market based on interest rates ignites courtesy of a bond sell-off.

The final reminder for readers: keep your wealth out of the system.

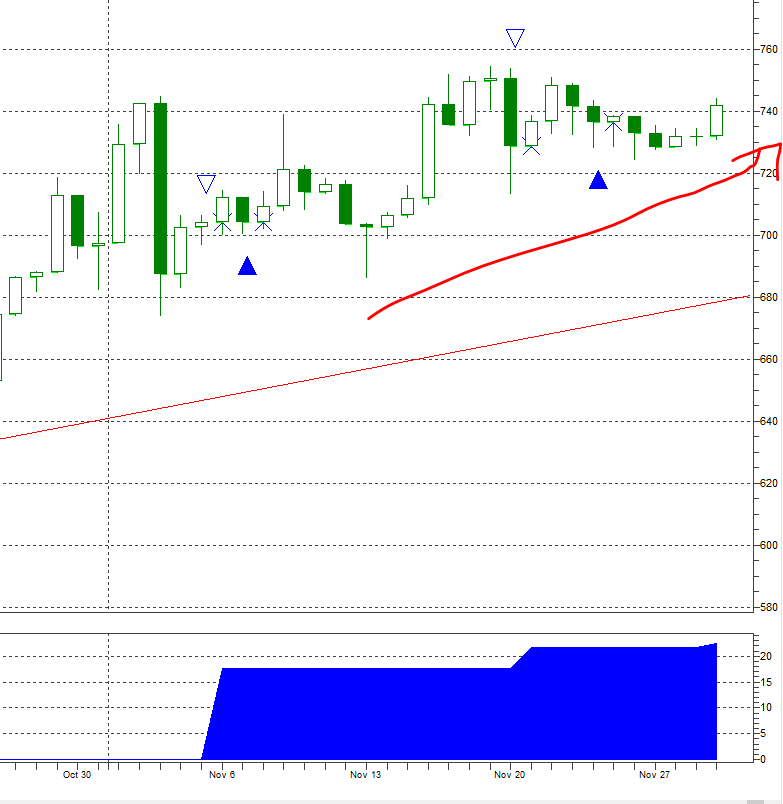

Bitcoin quick update: Bitcoin trend analysis (1st Dec 2016)

Bitcoin upward trend seems to be recovered to 743 level. Looking forward to $1000 level early 2017.

Since credit freezing is getting worst in China, it may be a factor to push up the bitcoin price. Just have quick look on the webbot report, Chinese property bubble would be in risk in early 2017.

US will join Belt and Road with China (Video in Cantonese)

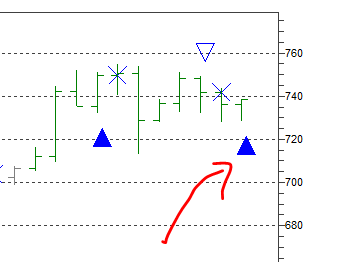

Quick Update: BUY Signal for Robot Fighter “S” (26.11.2016)

In the bitcoin chart analysis, the Robot Fighter “S” generates a BUY signal today. See if it is a profitable trade.

Robot Dog “B” Quick Update Bitcoin trend analysis: upward trend recaptured (on 25th Nov, 2016)

There is a BUY signal today. “B” confirmed the reversal point and the upward trend recaptured.

Quick Update: Exit Signal for Robot Fighter “S” (24.11.2016)

The bitcoin chart analysis for Robot Fighter “S” shows an EXIT Signal today. The current price of Bitcoin is $741

As shown in above table, -1.08% is recorded.

First Quick Update Robot Fighter “S” (23th Nov 2016)

This was a BUY signal on 18.11.2016. The bitcoin price has a little correction from $750 to $720 level. The price has recovered today to $746, and there is no EXIT signal in these few days.

Video Explanation

English Video

Chinese Video

Long term bitcoin trend analysis ($8,000 to $9,000 in September 2017)

To project the long-term trend of bitcoin price, I built up a bitcoin trend chart in log-scale to be the y-axis. The exponential equation shown on the diagram becomes a straight line. The R-Squared value is 0.7969 ~ 0.8. It is a value between 0 and 1. If the curve is very fit the data, the value will be near to 1. It means the trend of the bitcoin price develops in an exponential curve pattern. In this chart, it projects that bitcoin price will reach $8,000 to $9,000 in September 2017. It may reach over $12,000 in 2019.

The explanation in English version

比特幣8000-9000美元一個?

How to prepare economic collapse?

By browsing Youtube channel of Clif High, Ron Paul, Jim Willie, Bill Holter, Jim Sinclair, and Bix Weir, all those great forecasters posted warnings to the economic collapse are coming very soon.

I try, to sum up, and reorganize their view and give a broad picture about what happen. The debt bubble cannot continue, and the debt price drops. Some long-term dated debt already falls for 20-40% world-wide. The reason behind the debt bubble boost is because of the lost of the confidence around the world about the 19.6 Trillion of US debt. The loss of trust on US dollar and US debt leads to other countries to sell out the US bond in the market. In the past, the US printing money and raise the debt ceiling, other countries did not sell out the US bond. It may be the balance between the fear of US military and the loss of confidence on USD. The two opposite forces reach a certain point of equilibrium. So, wars continued, and Money printing did not stop.

However, after Russian helped to finish the middle east chaos within a short period while the US cannot do so for a much longer period, this equilibrium point of the two opposite forces begins to shift. Money continues to print, but the confidence of the USD begins to lose rapidly. The countries around the world start to sell their US Debt in the market. The Federal Reserve Board print more debt to absorb the sold out debt to keep the price of the US bonds. Recently, the US bond price drops because this second equilibrium point begins to shift. The balance between demand and supply lost. The money printing machine cannot support the selling force of the debt which reflects the confidence of USD lost at a high rate. The confidence and the credit are the bases of everything because it is the foundation of fiat currencies. The printing of 1 dollar USD based on the 1 dollar of US debt plus its interest. As the confidence lost, we the interest of the US bond increases. The pressure of increasing bank saving and loan interests will increase. However, this is the third balance point because all the companies loan from the bank and all the mortgage of the real estate properties are tightened to the bank interest rates. The third balance point will break and will begin to shift and it implies the coming boast of the bubbles of the two markets. All the two markets are highly correlated to the markets all around the world. We may see the world markets prices drops whatever the real estate prices or the stock market prices. The currencies of third world countries like the India and Egypt currencies failures. The exchange rates of USD to other currencies rise is because the demand from the US debt sellers sold out the US bonds and get US dollars. Then, they will convert the USD to their within countries bonds and the coming SDR (Special Drawing Right) bond. Some countries will also buy bitcoin as their reserves. I predict that the rising of USD exchange rates will end finally because the reflect the vanish of the US dollar. The vanish of USD will appear by the rapid rise of the physical GOLD and SILVER price. The ban of the 1000 and 500 India Rube leads to the $2,800 per oz of GOLD (update info from Jim Sinclair, it reach $3600 per oz of physical gold in India now). This is the road to hyperinflation. GOLD (physical gold) price will go to infinity with respect to USD although gold (paper gold) in Comex gold market are still $1,200-1,300 per oz of gold. The credibility of COMEX market will drop to zero and the price of GOLD around the world rise to infinity. The value of USD in relate to GOLD will also drop to zero.

The US will be forced to publish a new USD which is backup by the GOLD in US treasury which is not the Federal Reserve Notes anymore. The new USD exchange rates to other currencies will drop 30% then 50% … may be 80-90% until the balance points reached.

Other fiat currencies like Hong Kong may lead to convert their USD reserves to other reliable assets otherwise their currencies will vanish with USD. If I am the decision maker the city I am living, I think SDR debt, RMB, GOLD and Bitcoin (in the later stage as it ‘s hard to convince the public) will be a safe heaven.