By browsing Youtube channel of Clif High, Ron Paul, Jim Willie, Bill Holter, Jim Sinclair, and Bix Weir, all those great forecasters posted warnings to the economic collapse are coming very soon.

I try, to sum up, and reorganize their view and give a broad picture about what happen. The debt bubble cannot continue, and the debt price drops. Some long-term dated debt already falls for 20-40% world-wide. The reason behind the debt bubble boost is because of the lost of the confidence around the world about the 19.6 Trillion of US debt. The loss of trust on US dollar and US debt leads to other countries to sell out the US bond in the market. In the past, the US printing money and raise the debt ceiling, other countries did not sell out the US bond. It may be the balance between the fear of US military and the loss of confidence on USD. The two opposite forces reach a certain point of equilibrium. So, wars continued, and Money printing did not stop.

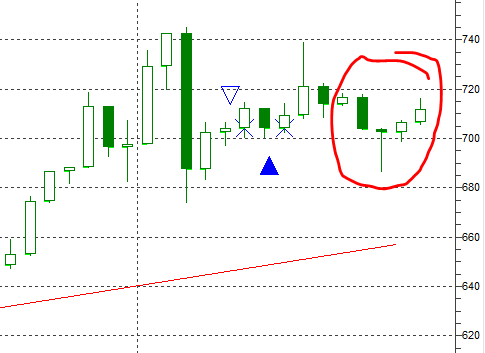

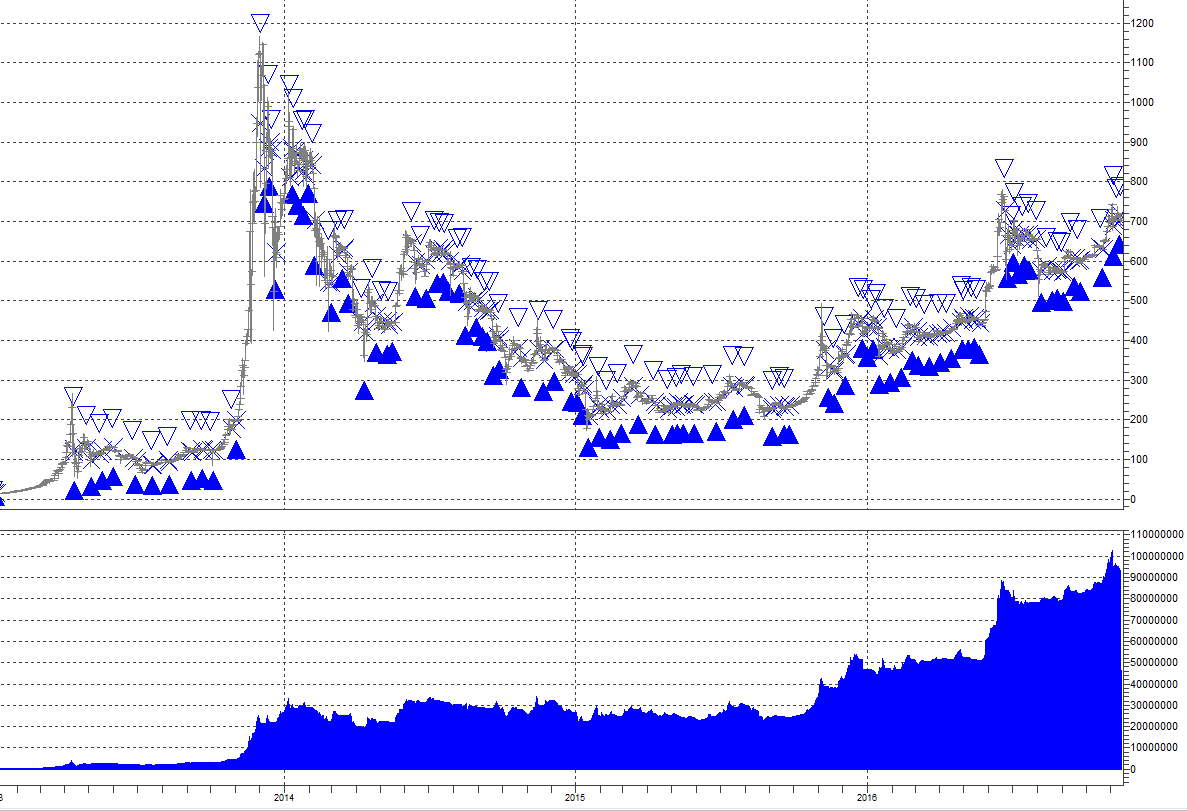

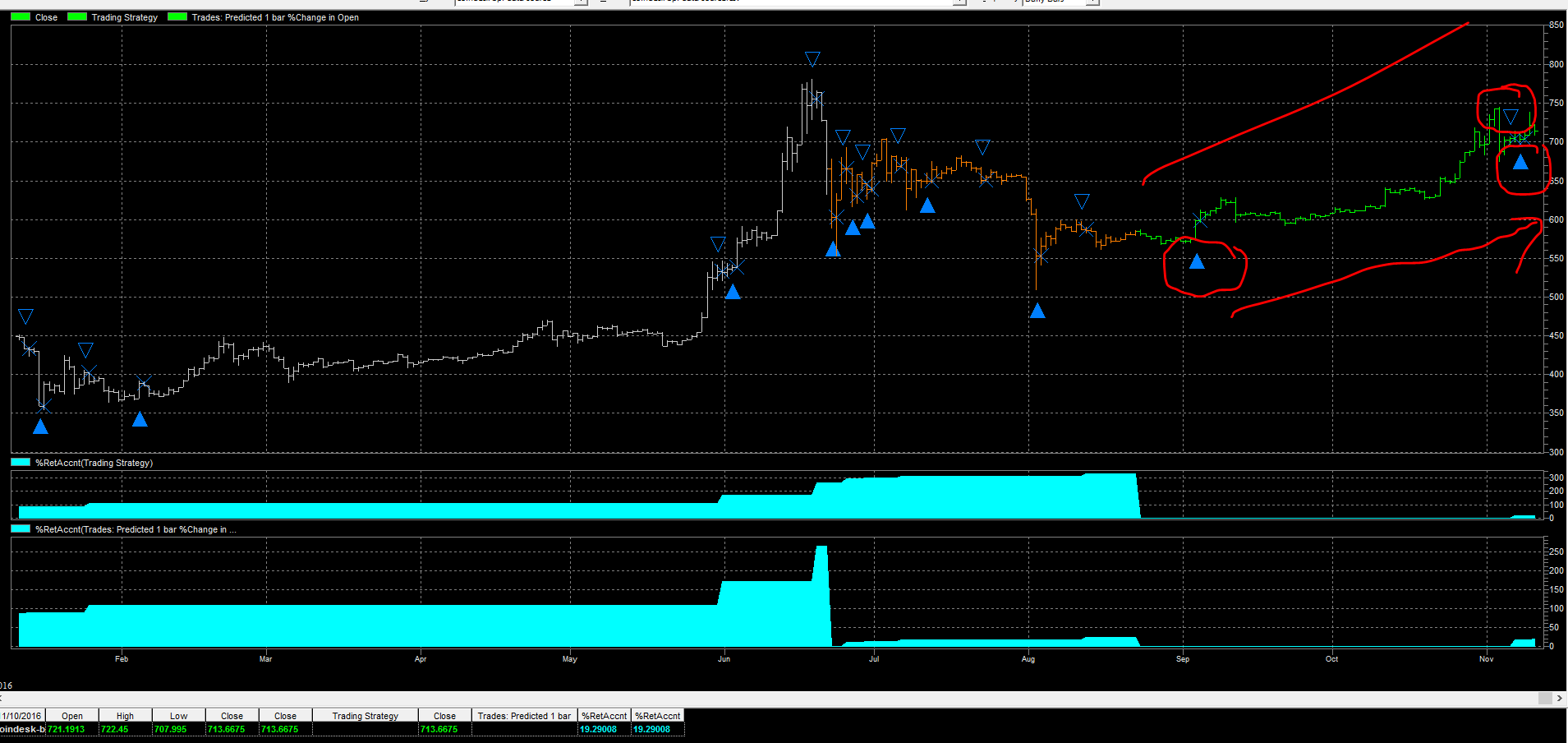

However, after Russian helped to finish the middle east chaos within a short period while the US cannot do so for a much longer period, this equilibrium point of the two opposite forces begins to shift. Money continues to print, but the confidence of the USD begins to lose rapidly. The countries around the world start to sell their US Debt in the market. The Federal Reserve Board print more debt to absorb the sold out debt to keep the price of the US bonds. Recently, the US bond price drops because this second equilibrium point begins to shift. The balance between demand and supply lost. The money printing machine cannot support the selling force of the debt which reflects the confidence of USD lost at a high rate. The confidence and the credit are the bases of everything because it is the foundation of fiat currencies. The printing of 1 dollar USD based on the 1 dollar of US debt plus its interest. As the confidence lost, we the interest of the US bond increases. The pressure of increasing bank saving and loan interests will increase. However, this is the third balance point because all the companies loan from the bank and all the mortgage of the real estate properties are tightened to the bank interest rates. The third balance point will break and will begin to shift and it implies the coming boast of the bubbles of the two markets. All the two markets are highly correlated to the markets all around the world. We may see the world markets prices drops whatever the real estate prices or the stock market prices. The currencies of third world countries like the India and Egypt currencies failures. The exchange rates of USD to other currencies rise is because the demand from the US debt sellers sold out the US bonds and get US dollars. Then, they will convert the USD to their within countries bonds and the coming SDR (Special Drawing Right) bond. Some countries will also buy bitcoin as their reserves. I predict that the rising of USD exchange rates will end finally because the reflect the vanish of the US dollar. The vanish of USD will appear by the rapid rise of the physical GOLD and SILVER price. The ban of the 1000 and 500 India Rube leads to the $2,800 per oz of GOLD (update info from Jim Sinclair, it reach $3600 per oz of physical gold in India now). This is the road to hyperinflation. GOLD (physical gold) price will go to infinity with respect to USD although gold (paper gold) in Comex gold market are still $1,200-1,300 per oz of gold. The credibility of COMEX market will drop to zero and the price of GOLD around the world rise to infinity. The value of USD in relate to GOLD will also drop to zero.

The US will be forced to publish a new USD which is backup by the GOLD in US treasury which is not the Federal Reserve Notes anymore. The new USD exchange rates to other currencies will drop 30% then 50% … may be 80-90% until the balance points reached.

Other fiat currencies like Hong Kong may lead to convert their USD reserves to other reliable assets otherwise their currencies will vanish with USD. If I am the decision maker the city I am living, I think SDR debt, RMB, GOLD and Bitcoin (in the later stage as it ‘s hard to convince the public) will be a safe heaven.